Is customer lifetime value (CLV) the new customer acquisition?

Federico D'Uva

Driving Revenue: The Importance of Customer Acquisition and CAC in E-commerce.

Continuous customer acquisition has long been the holy grail of marketing strategy. Its mission is crystal clear: Bring in as many new customers as possible and reap the rewards in additional revenue. With customer acquisition comes customer acquisition cost (CAC) — often considered the "golden metric" for measuring e-commerce success. By calculating how much money it costs to acquire new customers, online retailers can track their return on investment (ROI) and make the most of their advertising revenue and digital marketing campaigns.

But is customer acquisition (and CAC) the golden metric e-commerce retailers say it is? What if another marketing strategy and metric provided a more significant ROI?

What is customer acquisition and CAC?

Customer acquisition is a marketing process for generating new customers in your e-commerce business. The more new customers you acquire, the more successful your business is. Or so the theory goes.

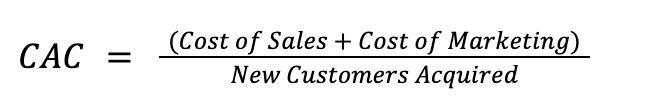

CAC is the metric that measures the costs of customer acquisition, and its calculation tells you the cheapest way to acquire new customers. You determine CAC by calculating how much money you spend on sales and marketing campaigns and dividing that figure by the number of new customers those campaigns brought to your business.

Say the value of each new customer to your business is £50. That's a tangible figure you can share with investors and other stakeholders, but it doesn't tell them the whole story about those customers. There is the minimal context behind that "£50" number.

What Customer Acquisition/CAC Doesn't Tell You

CAC isn't a bad metric. It can help you determine how much value customers bring to your business so you can predict profitability. However, CAC isn't always the greatest calculation for determining what brought those customers to your business in the first place. That's because CAC measures sales and marketing expenses, but it doesn't say what specific tools or strategies led to successful customer acquisition. For example, was it that social media campaign that acquired customers? Or that new email marketing software you recently implemented?

Another thing about CAC is that it only tells you about the here and now. The measurement reveals the value of acquiring new customers at this precise moment but fails to predict the value of those customers' future value. Say, again, the value of each new customer to your business is £50. Will those customers still be "worth" £50 in a few months? What about this time next year? What about in five years? That is something that Customer Lifetime Value (CLV) can help with.

What is Customer Lifetime Value (CLV)?

Customer lifetime value (CLV or CLTV) uncovers the total value of your customers during your entire relationship with them. It removes the focus from acquiring new customers to projecting the future growth of your business. It's a forward-thinking metric that provides more context than CAC ever could.

You can measure CLV through an equation that considers the average revenue of a customer account, churn rate, and gross margin. It's a slightly more complicated calculation than CAC, but it tells you much more about your customers, which is good. CLV considers whether customers will continue to contribute to your business over time so you can nurture the customers that will bring you the most value in the future. Think of CLV as the metric for determining the success of your business as a whole.

By using CLV over CAC, you can still measure the process of acquiring new customers, but you will be doing it through a new lens. CLV helps you find the type of customers you should be acquiring because they provide the greatest ROI over time.

Why is Customer Lifetime Value cheaper than customer acquisition?

Customer acquisition can be expensive. Research reveals that it costs anywhere from five to 25 times more money to acquire a new customer than retain an existing one. So by shifting your focus from acquiring as many new customers as possible to finding, nurturing, and maintaining relationships with "high-value" customers, you can save money and grow your e-commerce business significantly.

The value of CLV

One of the key reasons for measuring CLV is customer journey maintenance. Research reveals that the likelihood of acquiring new customers is 5%–20%, whereas converting an existing client is 60%–70%.

It is in a business's best interest to assess how much of its sales can be attributed to first-time buyers compared to returning customers. If retention rates are low, it can motivate companies to invest time and money into retention strategies and see if there are any quick wins to be achieved.

Final Word

Customer lifetime value (CLV) is just as important as customer acquisition, if not more so. That's because it focuses on the customer relationship as a whole and the future profitability customers can bring to your business. When used in conjunction with other metrics, CLV can help you make smarter, more informed decisions.